The Power of Staying Invested

Posted on January 11, 2024 in Investment Strategy

Posted on January 11, 2024 in Investment Strategy

As the new year unfolds, individuals around the world engage in a variety of rituals and activities, marking a time of renewal and fresh starts. Many will set personal resolutions, striving for healthier lifestyles or acquiring new skills, while others indulge in cultural traditions that promise good fortune. A less conventional annual ritual of mine involves updating and reviewing market returns data. This practice not only helps prepare me for the circuit of presentations I give in the early months of each year but also consistently underscores a fundamental truth in the realm of investing: the importance of staying invested over long periods.

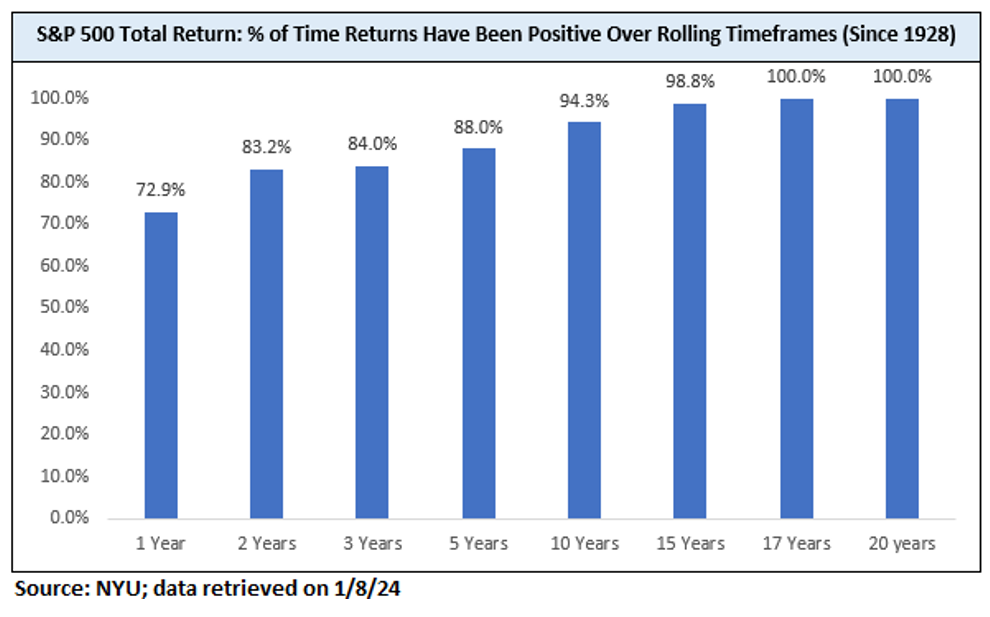

My late partner John Washington always stressed the importance of time in the market over timing the market. While many prognosticators may tell you otherwise, no one has a crystal ball, especially when it comes to market returns. Sometimes doing less is doing more, and indeed that’s exactly what the chart below would suggest. Since 1928, S&P 500 returns, including dividends, were positive over a one-year period 73% of the time. This percentage climbs to 88% for all rolling five-year periods over the same time frame. Most compellingly, for all rolling periods extending 17 years and beyond, the data shows that returns have been positive 100% of the time! Of course, past performance is no indication of future results. That said, the data sure seems to suggest that John Washington was onto something!

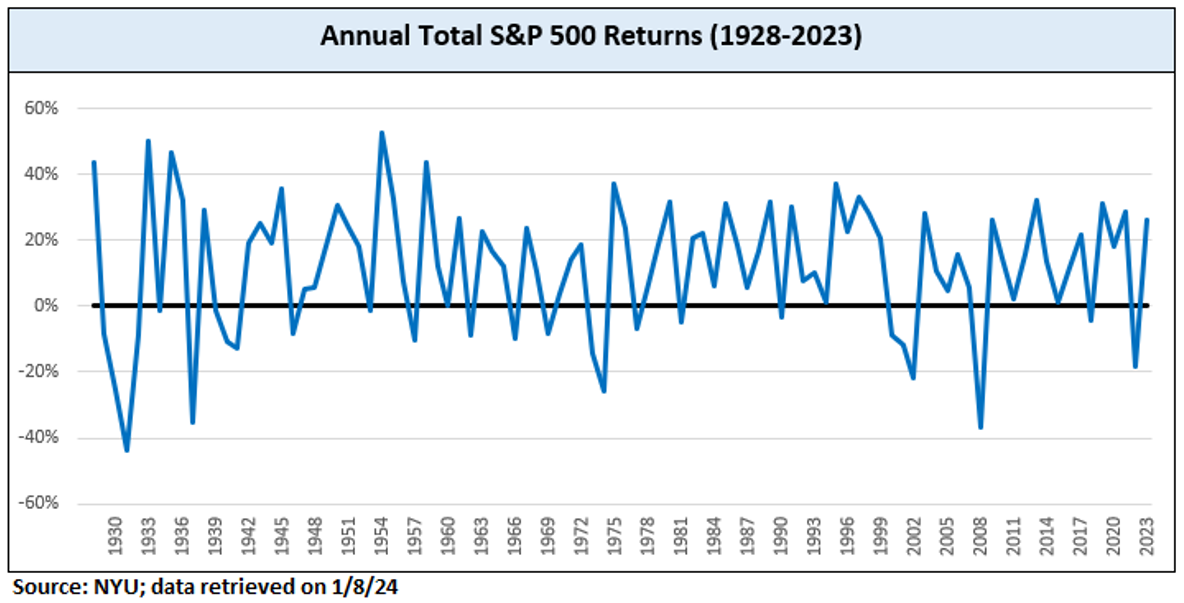

Market returns in the short term, however, are far from reliable as evidenced by the chart below. Some years have been really good, while others have been really bad. Interestingly, market returns in any given year have rarely been close to the 1928-2023 annualized total return of 9.8%. In fact, there have only been four years in the 96-year sample size that have finished within plus or minus two percentage points of this number. This inconsistency makes it difficult to remove emotion from the investment process. Moreover, those who attempt to time the market by getting in and out run the risk of missing out on short periods of massive outperformance. I think most would agree that the past couple of years have proven how unpredictable the markets can be, so why try?

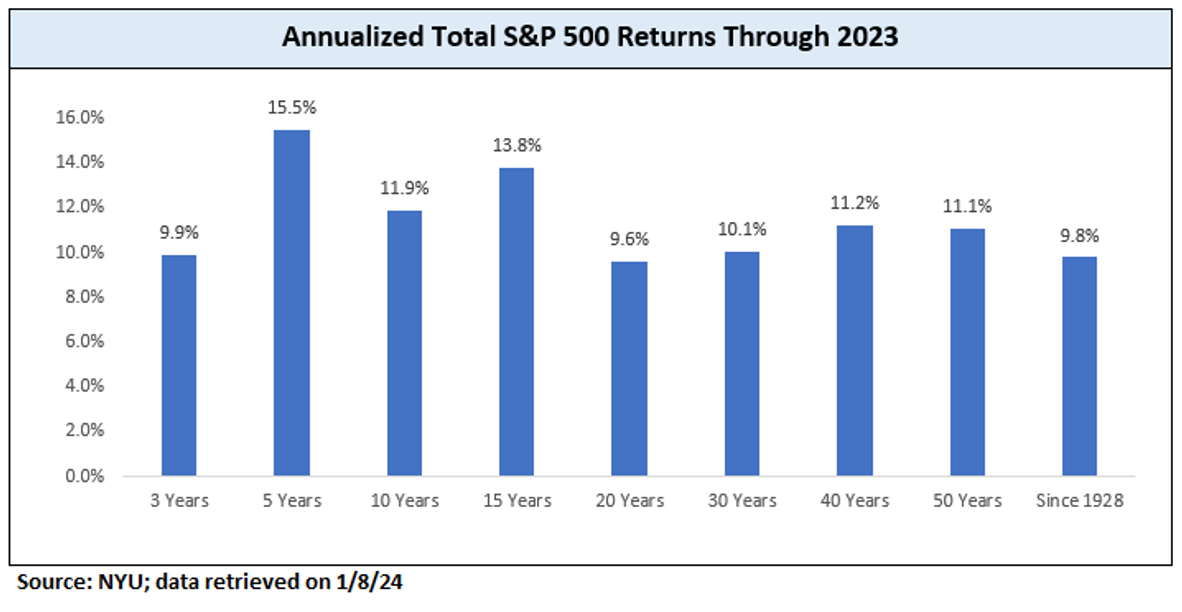

Zooming back out, we again see that staying invested for long periods of time has consistently proven to be a fruitful endeavor. The below chart is a good reminder that despite all the troubling events that have occurred over the decades, from wars to financial panics to pandemics, the stock market has consistently gone up and to the right. The volatility experienced in the short term is the cost of admission for seeing your money compound over the long term!

It is important to remember that the data discussed above only provides a framework for how to think about long-term investing. Perhaps needless to say, every investor has different risk tolerances and liquidity needs that may get in the way of remaining fully invested. But the most important part of investing is to have a plan and stick with it. If one of your New Year’s resolutions is to get your finances in order, we would be honored to help you achieve your goals.

Farr, Miller & Washington is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.